Collect ESG metrics across your portfolio with just a few clicks

- Track progress of your investments against ESG mandates

- Generate outputs to inform regulatory reports effortlessly

Overcome your ESG data challenges with Dasseti ESG

Standardize data

Without standardized ESG reporting frameworks it will be hard to compare different portfolios and assess the ESG performance of your investments.

Lack of visibility at at the entity level

It is difficult to get visibility into portfolio companies and funds, as data is provided by GPs who may not have the right systems and processes in place. Dasseti ESG can meet GPs data collection challenges.

Unclear reporting guidelines

Portfolio companies may be unsure about how to report their ESG metrics to GPs. Put clear guidelines and expectations in place for GPs, to share with portfolio companies.

Collaborate with industry initiatives

Participate in industry initiatives like the ESG Data Convergence Initiative (EDCI), which defines a set of ESG metrics to collect.

How does Dasseti ESG work?

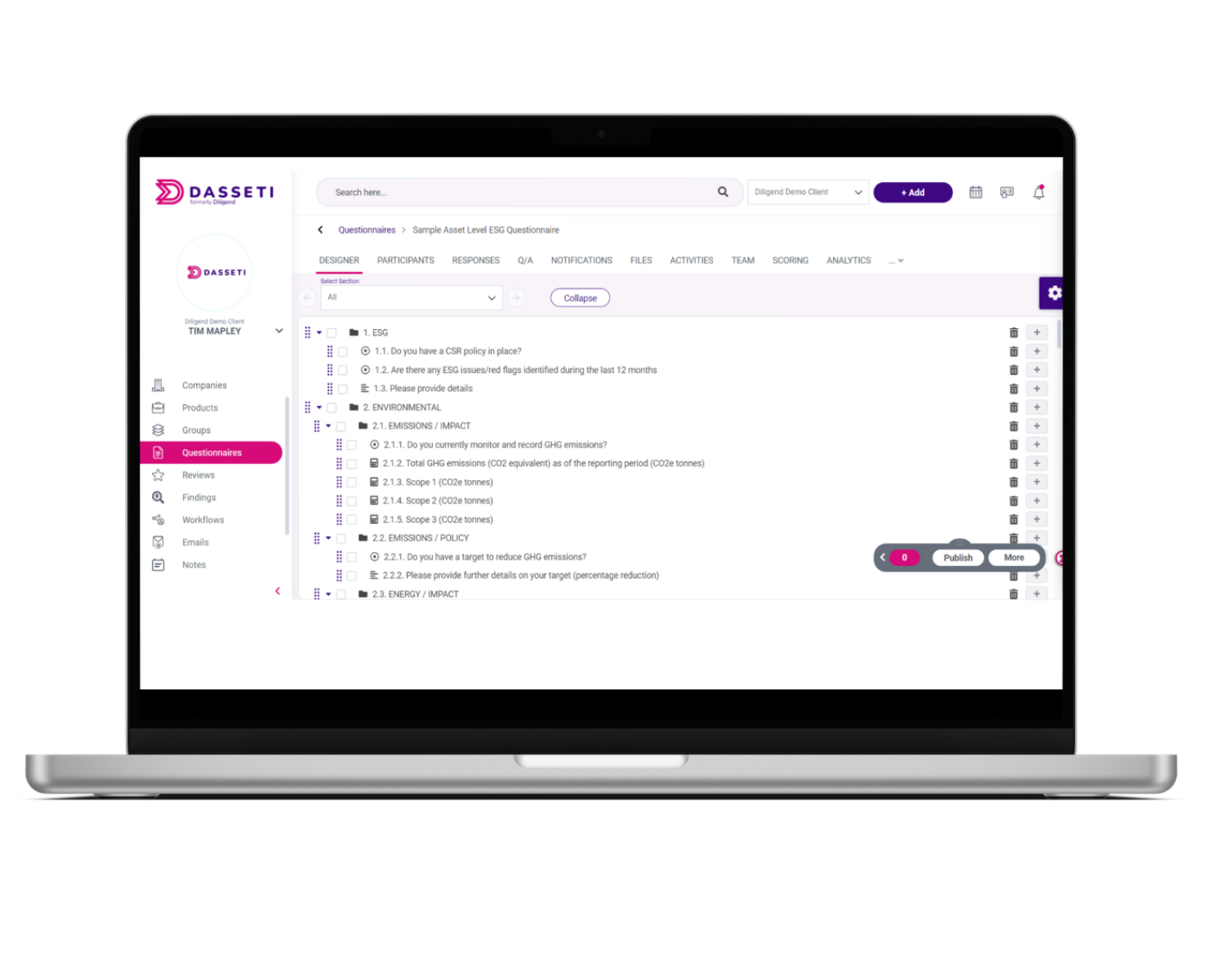

Step 1 - Define

Step 1 - Define

Define the metrics you need to:

- Meet regulatory requirements

- Map data to different frameworks

- Benchmark performance against industry peers

- Measure progress

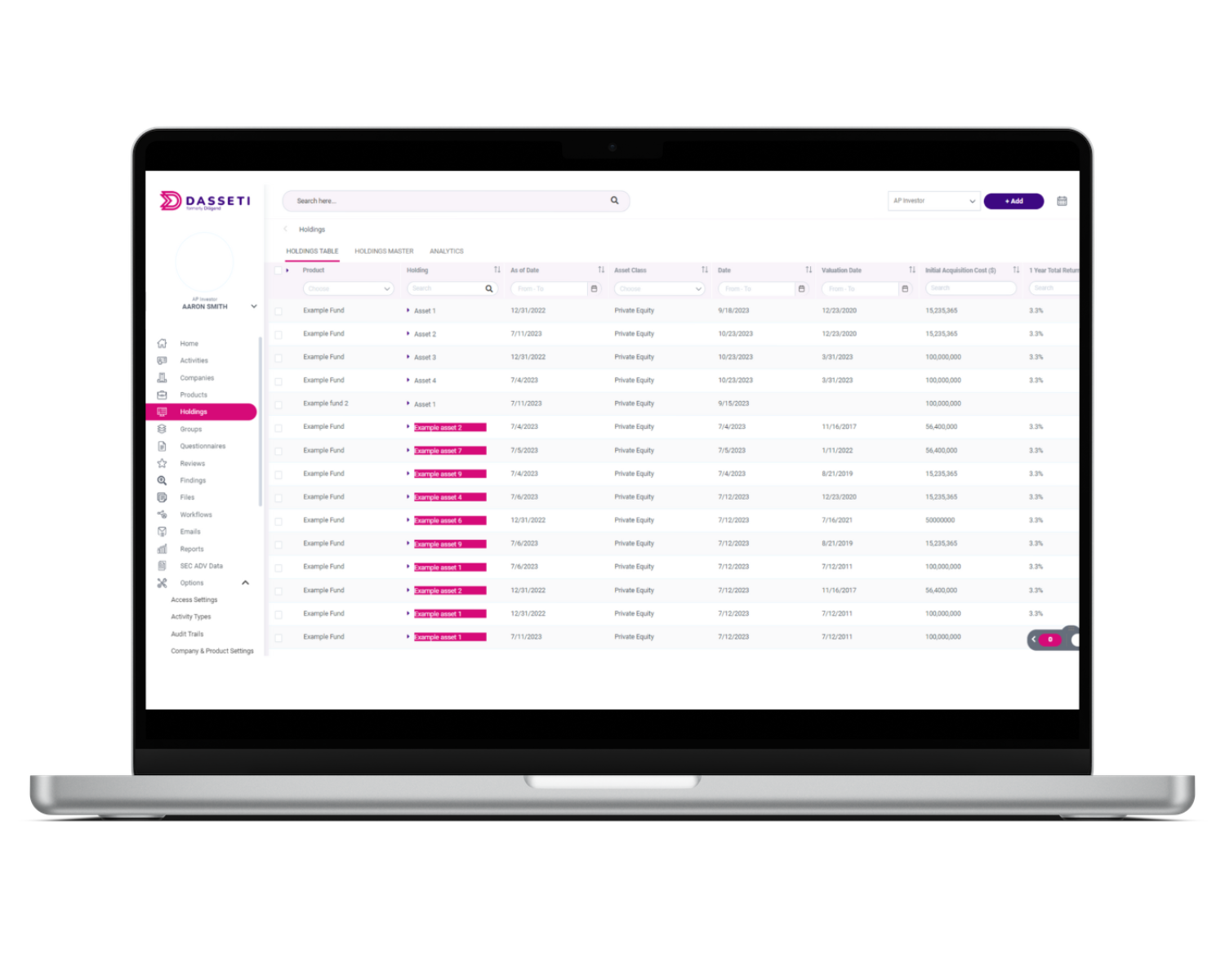

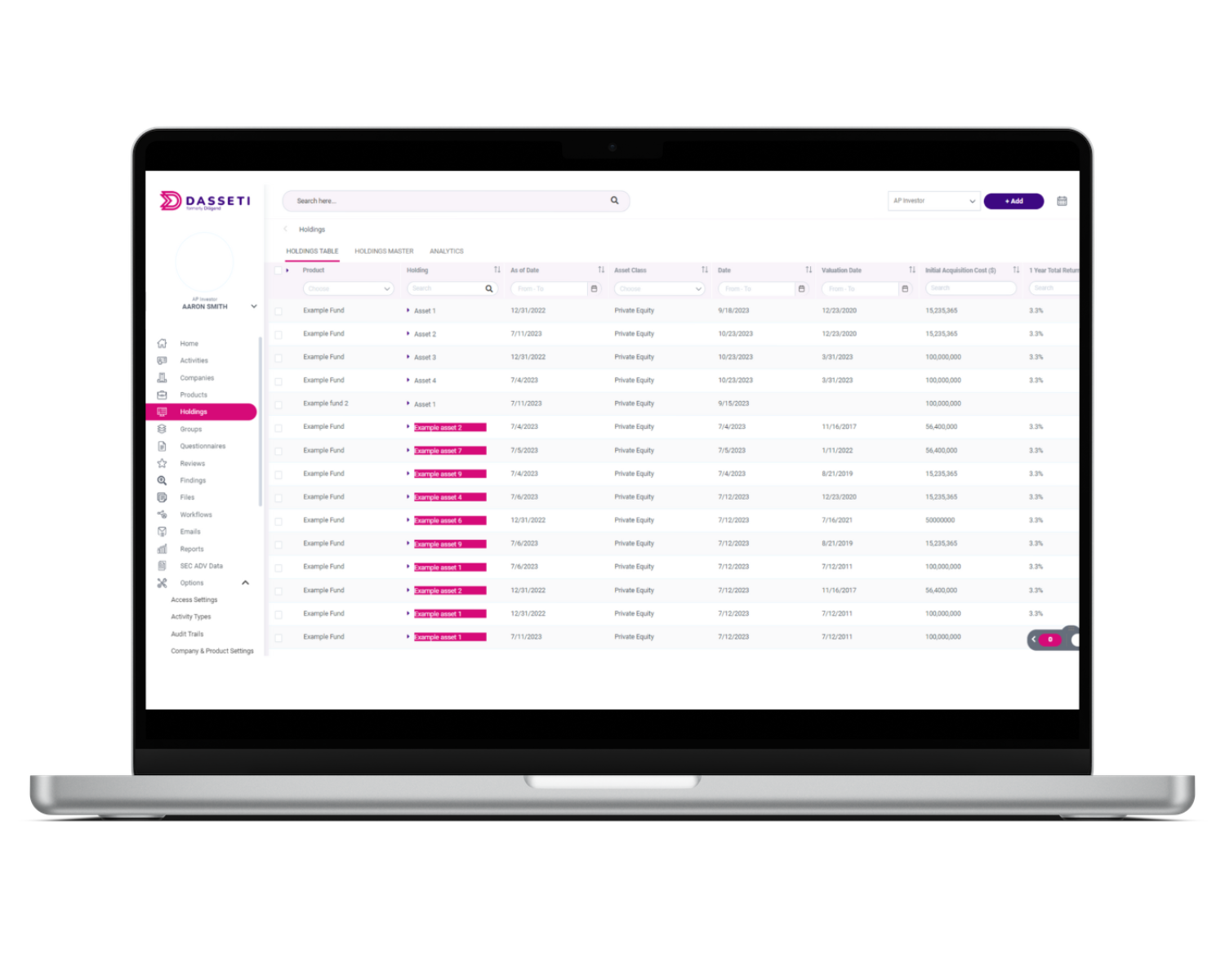

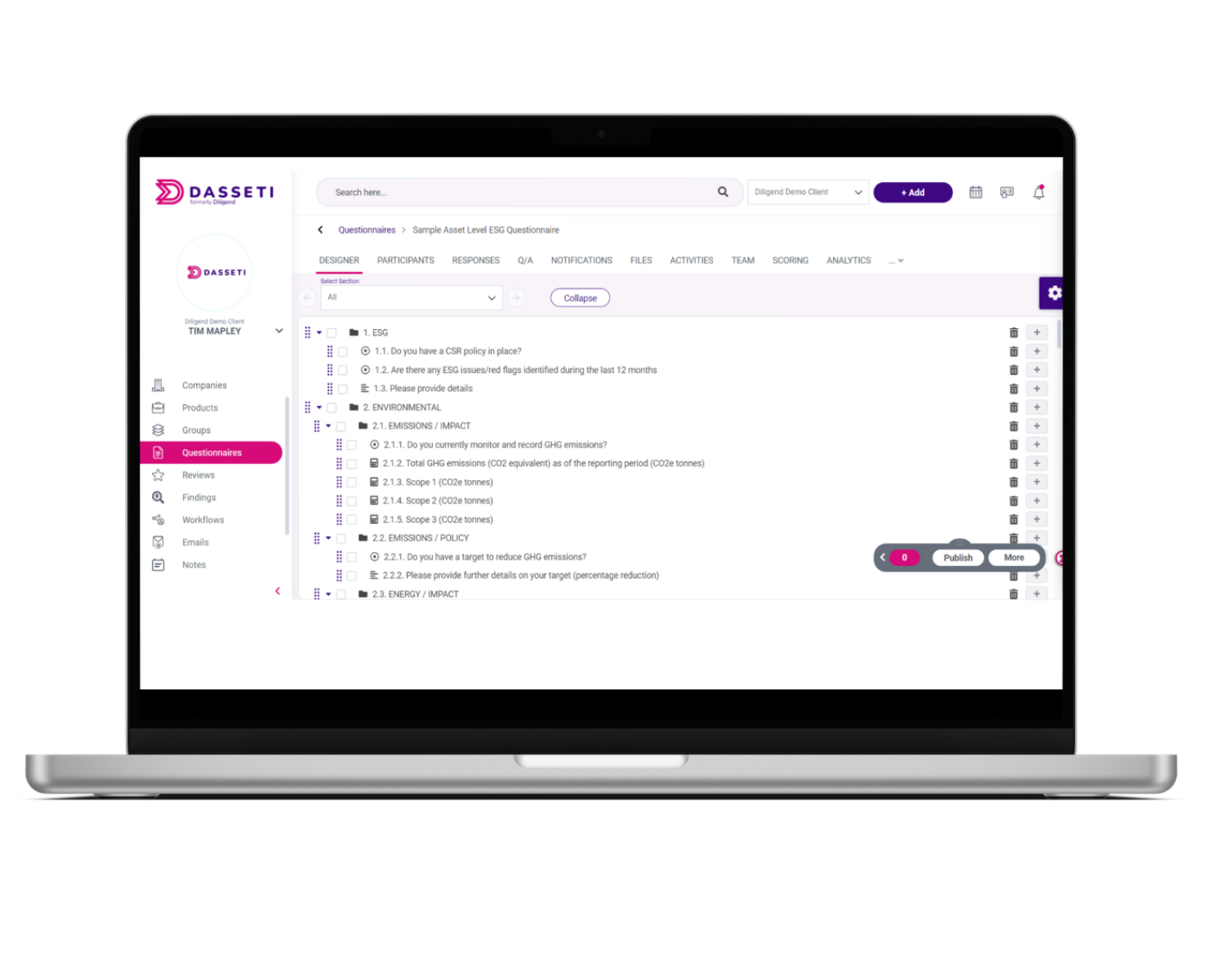

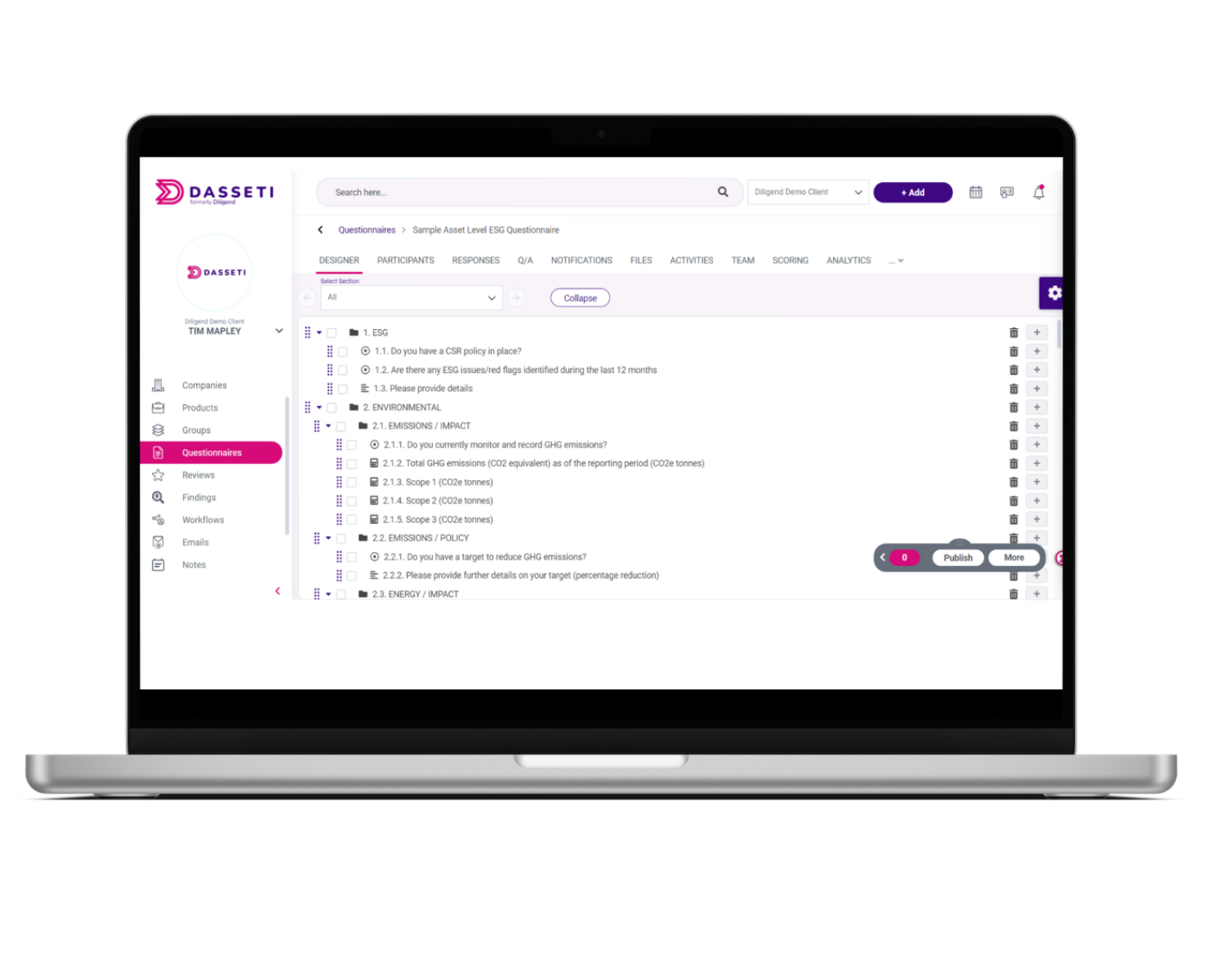

Step 2 - Collect

Step 2 - Collect

Dasseti is the private equity sector's leading ESG data collection platform for:

- Secure, one to one data collection direct from portfolio companies and funds

- Distribute data collection link to any number of entities in seconds

- Secure, easy to use response portal allows users to copy from previous responses via Smart Response feature.

Step 3 - Enrich and Validate

Step 3 - Enrich and Validate

Enrich and validate your proprietary ESG data.

- EDCI validation

- Compare progress over specific time periods

- Benchmark against industry peers

- Aggregate data sets for easier comparison

- Standardize data to make querying easier

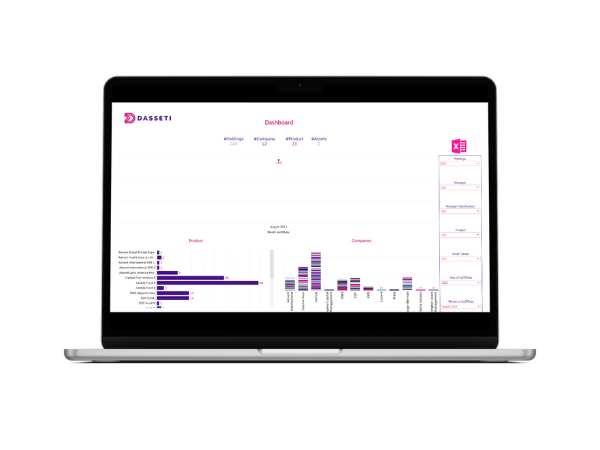

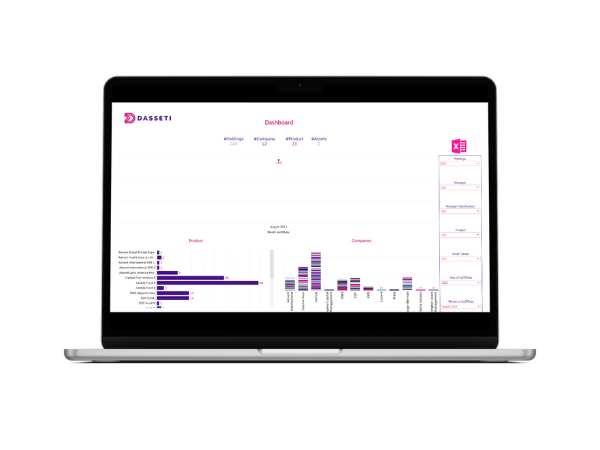

Step 4 - Report

Step 4 - Report

High quality customizable outputs for client reporting and to assist with regulatory disclosures:

- Fill data voids with publicly available proxy data

- Dynamic dashboards

- Client-specific reporting

- Year on year progress tracking

- Industry specific reporting

Step 1 - Define

Define the metrics you need to:

- Meet regulatory requirements

- Map data to different frameworks

- Benchmark performance against industry peers

- Measure progress

Step 2 - Collect

Dasseti is the private equity sector's leading ESG data collection platform for:

- Secure, one to one data collection direct from portfolio companies and funds

- Distribute data collection link to any number of entities in seconds

- Secure, easy to use response portal allows users to copy from previous responses via Smart Response feature.

Step 3 - Enrich and Validate

Enrich and validate your proprietary ESG data.

- EDCI validation

- Compare progress over specific time periods

- Benchmark against industry peers

- Aggregate data sets for easier comparison

- Standardize data to make querying easier

Step 4 - Report

High quality customizable outputs for client reporting and to assist with regulatory disclosures:

- Fill data voids with publicly available proxy data

- Dynamic dashboards

- Client-specific reporting

- Year on year progress tracking

- Industry specific reporting

Secure, one to one ESG data collection and analysis platform

- Share industry standard DDQs from ILPA, AIMA or the PRI with your GPs in just a few clicks.

- Secure collection and analysis platform.

- Automate flagging and aggregation as responses come in.

Dasseti joins the ESG Data Convergence Initiative as one of the first ESG Data Partners

Dasseti is partnering with the EDCI to enable the initiative benchmark to be viewed directly within our platform.

ESG Reporting: Navigating the Myriad Standards

With multiple ESG standards and reporting options, what represents best practice?