Make Sense of Massive Amounts of Data

Use AI-powered automation to collect, analyze, and aggregate data at the manager, fund, and holdings level - faster and more accurately.

Perform due diligence and monitoring at scale, across all asset classes

Automate manual tasks and enhance oversight with AI-driven analytics across external managers, funds and even underlying holdings.

Dasseti COLLECT provides Fund of Funds and multi-managers with granular oversight and control over funds and managers regardless of asset class or strategy.

Overcoming information hurdles in Fund of Funds

-

Data Aggregation

-

Performance Attribution

-

Risk Management

-

Regulatory Compliance

-

Due Diligence

-

Transparency

Data Aggregation

Collecting and consolidating data from multiple underlying funds is one of the biggest operational challenges for fund of funds teams. Each manager provides data in different formats, with varying levels of quality and completeness.

Dasseti COLLECT uses AI to digitize, standardize, and validate incoming information automatically, cutting manual work and minimizing errors. This ensures a consistent data foundation that can be used confidently across reporting, risk, and performance analysis.

Performance Attribution

Understanding which underlying funds, strategies, or asset classes are driving returns is essential for informed decision making. But without structured, timely data, attribution analysis becomes guesswork.

Dasseti COLLECT brings transparency to performance data, allowing teams to slice results by manager, strategy, or factor exposure in real time. With cleaner inputs, performance attribution becomes faster, more reliable, and actionable.

Risk Management

Assessing and managing risk across a diversified portfolio requires visibility into both quantitative and qualitative factors.

Dasseti COLLECT integrates AI-driven risk flagging to automatically surface potential issues - such as changes in management, style drift, or anomalies in reported metrics. This enables proactive monitoring and early intervention before small risks become significant problems.

Regulatory Compliance

For fund of funds operating across multiple jurisdictions, compliance reporting can quickly become a full-time task.

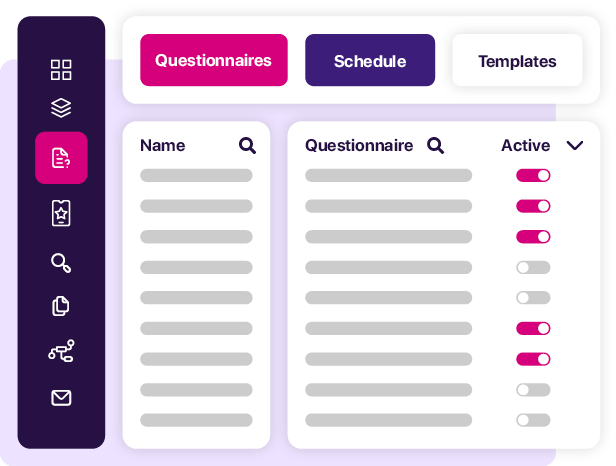

Dasseti COLLECT streamlines the process with customizable templates that pull live data from the platform. Reports can be automated on a recurring schedule, ensuring accuracy, timeliness, and consistency across all required disclosures.

Due Diligence

Conducting due diligence across dozens or even hundreds of underlying funds is resource-intensive.

Dasseti COLLECT simplifies the process by automating manager questionnaires, collecting supporting documents, and flagging incomplete or inconsistent responses. Its AI-enabled workflows reduce administrative load while maintaining a high standard of qualitative review, giving teams more time to focus on analysis rather than admin.

Transparency

Investors expect clarity on how their capital is allocated and how it performs over time.

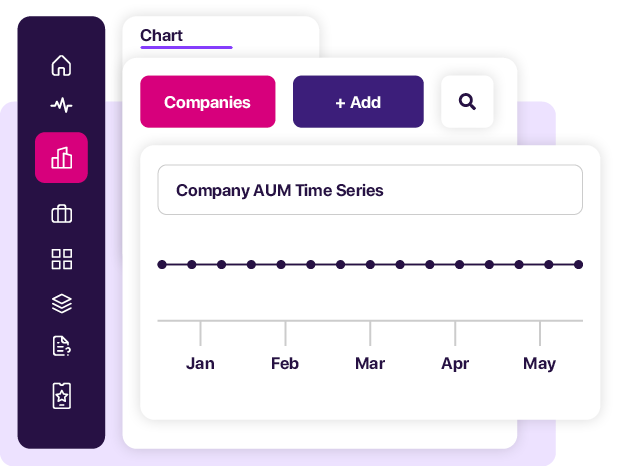

Dasseti COLLECT makes it simple to provide that transparency through customizable, dynamic reports that visualize underlying holdings, exposures, and trends. Interactive charts, time-series views, and comparative analytics make it easier to demonstrate progress and accountability to stakeholders.

Download the Fund of Funds Oversight Playbook

See how leading FoF teams are structuring their data, automating reviews, and building a more connected oversight process without adding headcount.

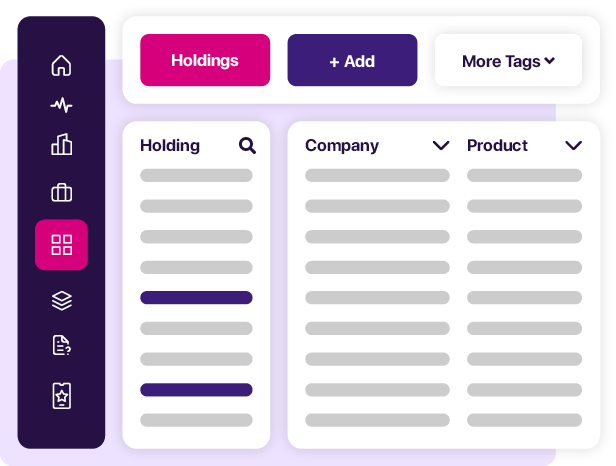

Key features of Dasseti COLLECT for Fund of Funds teams

DDQ Engine

Create questionnaires from scratch, use best practice templates or ingest pre-filled questionnaires. Simple, intuitive and customizable.

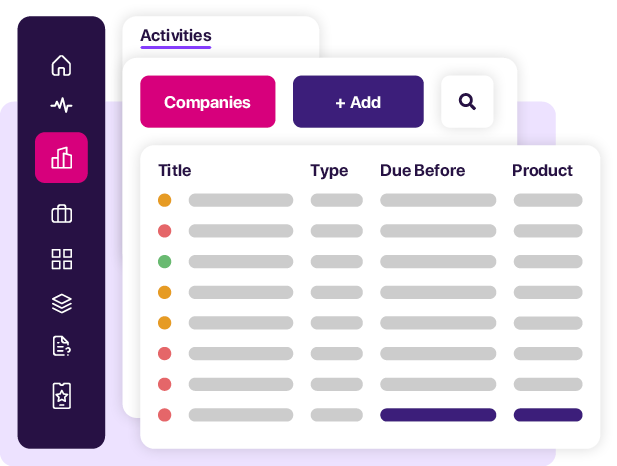

Get a View of Individual Holdings

Full transparency through your managers, funds and underlying entities. Collect and aggregate data all in one platform.

Manager Portal

The white-labelled manager portal is user friendly and intuitive. Managers can leverage AI-powered pre-filling from previous answers.

CRM and Document Management

Outlook and SharePoint integrations let you track contacts, emails and shared documents. Enrich your data.

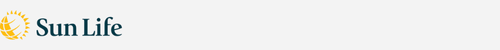

Workflows and Collaboration Tools

Fully customizable to match your own processes. Allocate tasks, track activities and progress. And see a full audit trail.

Review and Risk Management

Review only the data you want to see in the fully customizable review module.

Automated Scoring and Comparison

See how the portfolio looks at a glance, with customizable, automated scoring and comparison.

AI-Driven Analytics and Reporting

Fully customized, automatic report creation in any format. Linked directly to your CRM or database.

Fund of Private Equity Funds: Collect and Report ESG data on your funds and the underlying entities

- Collect fund level ESG data, to analyze and report entity, by sector, or roll up into a full portfolio overview.

- Support regulatory reporting requirements and meet client engagement goals.

Client Case Studies

SITUATION

SLC Management, the institutional asset management division of Sun Life, needed to streamline due diligence and monitoring for over 100 external managers worldwide.

Manual questionnaires, fragmented data, and inconsistent processes made manager oversight time-consuming and difficult to scale.

SOLUTION

The team implemented Dasseti COLLECT to centralize manager information, automate quarterly questionnaires, and standardize workflows.

With Dasseti’s support, onboarding was smooth and collaborative, creating a single source of truth for all responses, attachments, and notes.

IMPACT

SLC eliminated repetitive manual tasks, achieving full consistency across manager reviews.

Questionnaire distribution dropped from hours to minutes, data became searchable and comparable across quarters, and the foundation was laid for future AI-driven insights.

SITUATION

AXA’s Zurich-based multi-asset team wanted to reduce time spent on manual manager monitoring and standardize processes across multiple asset classes.

SOLUTION

Using Dasseti COLLECT, AXA automated manager information requests, introduced AI-driven risk flagging, and implemented a consistent, repeatable review framework.

The team also centralized manager data and workflows within a single platform for faster access and improved oversight.

IMPACT

AXA onboarded 55 managers and their historical data within two weeks.

By week four, automated data collection and custom dashboards were live - cutting ongoing monitoring time by 50%.

Related Insights

5 Oversight Risks Fund of Funds Face – and How to Eliminate Them

How Fund of Funds managers can eliminate oversight risks with AI-powered monitoring, real-time data, and streamlined compliance workflows.

Closing Coverage Gaps: How Fund of Funds Can See the Whole Picture

How Fund of Funds teams can eliminate oversight blind spots with Dasseti COLLECT - automating data collection, monitoring, and risk detection.

How Fund of Funds Teams Can Standardize Data and Strengthen Oversight

Fund of Funds due diligence teams face inconsistent manager data and reporting formats. Learn how data standardization improves accuracy and oversight.