Dasseti Sidekick

Intelligent. Embedded. Always Evolving.

Sidekick is Dasseti’s AI assistant, built to work within our clients' workflows. Helping teams save time, enhance quality, and unlock structured insights from day one.

AI that works the way you do

Sidekick is embedded directly into Dasseti COLLECT and ENGAGE, guiding tasks like data extraction, response drafting, document querying, and content refinement.

- Responses become structured, searchable data you can build on.

- AI follows clear steps to deliver accurate, consistent results.

- You’re always in control, Sidekick works quietly in the background, reducing manual effort.

- Documents stay secure, with privacy built in from the start.

Auto-Filling DDQs Using Source Files

Within Dasseti COLLECT

Ask Sidekick to extract relevant information from ADV filings, policies, and manager reports, and auto-fill your DDQ drafts, ready for review and clarification.

How it works:

- Upload manager documents (PDF, Word, Excel)

- Sidekick extracts and maps the right data to your DDQs

- Analysts review, refine, and send for clarification

Why it matters:

Sidekick transforms source documents into structured responses, meaning you’re not just speeding up one DDQ, you’re building a searchable data trail for the future.

How it works:

- Upload manager documents (PDF, Word, Excel)

- Sidekick extracts and maps the right data to your DDQs

- Analysts review, refine, and send for clarification

Why it matters:

Sidekick transforms source documents into structured responses, meaning you’re not just speeding up one DDQ, you’re building a searchable data trail for the future.

Draft responses to RFPs in One Click

Within Dasseti ENGAGE

How it works:

- Upload or sync approved past responses

- Sidekick understands question intent and fills in the draft

- You polish or approve with minimal rework

Why it matters:

You provide faster, more consistent responses and every interaction adds to your long-term content bank, making the process more efficient over time.

Reduce time spent digging through old RFPs or internal threads. Sidekick instantly suggests answers from your approved content bank and internal documents.

How it works:

- Upload or sync approved past responses

- Sidekick understands question intent and fills in the draft

- You polish or approve with minimal rework

Why it matters:

You provide faster, more consistent responses and every interaction adds to your long-term content bank, making the process more efficient over time.

Reviewing Responses at Scale

Within Dasseti COLLECT

Use Sidekick to identify missing information, flag risks, and compare manager response in a fraction of the time.

How it works:

- Sidekick highlights missing information or inconsistencies

- Sentiment scoring flags ESG, operational, or investment risks

- Intelligent suggestions surface key follow-ups

Why it matters:

Sidekick helps you scale review with confidence, giving teams the insights they need without adding hours of manual comparison work.

How it works:

- Sidekick highlights missing information or inconsistencies

- Sentiment scoring flags ESG, operational, or investment risks

- Intelligent suggestions surface key follow-ups

Why it matters:

Sidekick helps you scale review with confidence, giving teams the insights they need without adding hours of manual comparison work.

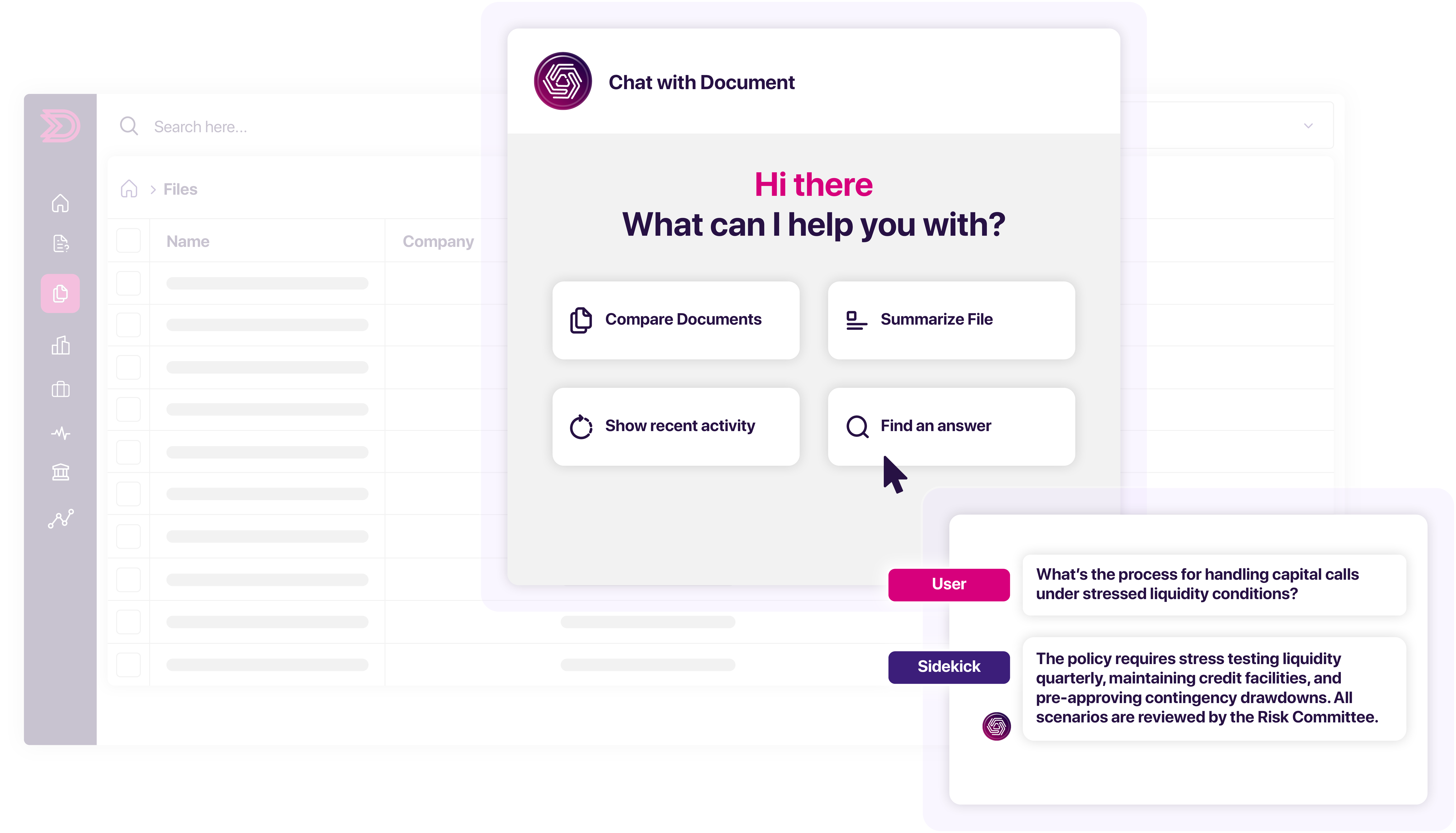

Query Your Entire Universe

Within Dasseti ENGAGE and COLLECT

How it works:

- Sync internal files and external sources like SharePoint and Google Drive

- Ask a question across all synced content

- Receive a generative, context-aware answer in seconds

Why it matters:

Knowledge Base removes the friction from finding information, no need to know where it’s stored or what file it’s in.

One query surfaces answers from across your ecosystem, turning scattered data into clear insight.

Ask Knowledge Base once. Search everything. No more toggling between tools, folders, or document types, just clear answers from one unified query.

How it works:

- Upload manager documents (PDF, Word, Excel)

- Sidekick extracts and maps the right data to your DDQs

- Analysts review, refine, and send for clarification

Why it matters:

Sidekick transforms source documents into structured responses, meaning you’re not just speeding up one DDQ, you’re building a searchable data trail for the future.

FAQs

What is Dasseti Sidekick?

Sidekick is Dasseti’s embedded AI assistant, built to streamline tasks within COLLECT and ENGAGE. It helps users extract data, draft responses, query documents, and review content, all within existing workflows.

What kinds of tasks can Sidekick help with?

Sidekick helps with data extraction from documents, auto-filling DDQs and RFPs, summarising or rewording responses, identifying inconsistencies, querying content, and more, all tailored to your workflows.

Can I trust the content Sidekick suggests?

Yes. Sidekick is designed to deliver reliable, reference-backed responses, not guesses. Every suggested answer includes clear source references to approved content, so you can verify the origin instantly.

Because Sidekick operates within a controlled environment and only draws from authorised data, it avoids the hallucinations commonly seen in generic AI tools. You remain in full control, with transparency built in at every step.

Is my data secure when using Sidekick?

Absolutely, security is built into every layer of Sidekick. Dasseti uses Azure OpenAI with strict enterprise-grade exemptions to protect your data. That means:

- GP documents are never stored in OpenAI’s systems

- All data is encrypted and processed in a closed-loop environment

- Our AI usage complies with institutional data governance standards

Where is my data stored and processed?

All data is processed securely within Dasseti’s infrastructure, with document privacy protected at every step.

How is Sidekick different from generic AI tools or chatbots?

Sidekick is task-specific, purpose-built, and embedded directly into your workflow. It delivers structured outputs, follows clear instructions, and avoids “black box” behavior common in generic tools.

Is this generative AI?

Yes. Sidekick uses large language models (LLMs), but in a tightly controlled environment tailored to investment and IR workflows.

Is Sidekick still evolving?

Yes. We’re continually expanding Sidekick’s capabilities, including advanced reporting, intelligent clarification prompts, and automation for recurring tasks, all while keeping you in control.

Inside Dasseti: AI Vision & Product Thinking

Engineering Efficiency: How Dasseti’s Sidekick is Transforming Due Diligence with Integrated AI

Dasseti’s Head of Product, Arjun Patel, unpacks the design principles behind Sidekick, and why this tool goes far beyond standard generative AI integrations.

On-demand: AI-powered solutions for fund managers

Our in-house experts walk you through how Sidekick can enhance efficiency, reduce manual tasks, and ensure consistency in every response.

Smarter Due Diligence: How Asset Managers Can Leverage AI Without Losing the Human Touch

How Dasseti's AI-powered tools help asset managers streamline RFP and DDQ processes while still preserving the human element.

Dasseti AI Roadmap

Our manager, institutional investor, consultant and ESG clients will benefit from Dasseti's AI development roadmap which includes multiple different applications of AI across the whole software portfolio.

If you are interested in becoming a collaborator, please get in touch.