In today’s rapidly evolving business and regulatory landscape, double materiality is becoming a key concept in corporate sustainability and financial decision-making. Going beyond the buzzword, this article will define the fundamentals of double materiality, explore recent research into its applications, and use the California wildfires as a real-world example of double materiality’s importance.

Defining Double Materiality

Double materiality extends the standard accounting concept of financially material information. According to the US Securities and Exchange Commission, information is material, and should therefore be disclosed, if “a reasonable person would consider it important.” This means that material information has the potential to influence decision-making by investors, stakeholders, or regulators. It might be important because it affects a company’s financial health, risk exposure, strategic direction, or long-term viability.

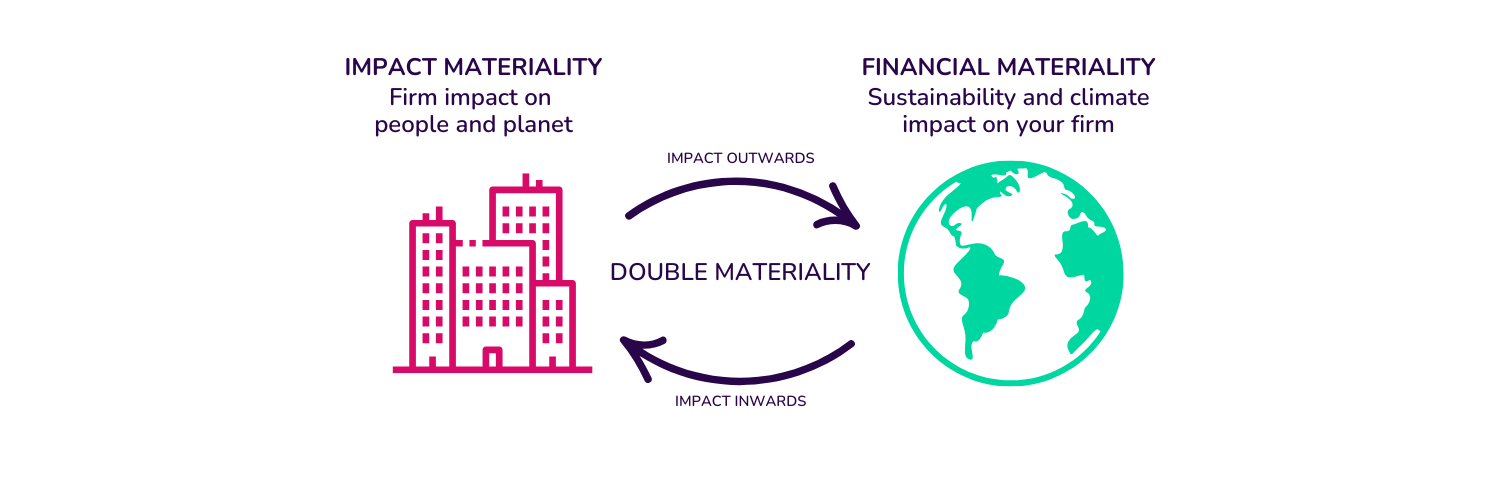

At its core, double materiality posits that sustainability-related factors can be material in two ways:

Financial Materiality: This "outside-in'' view emphasises how external environmental or social factors may pose a material risk or opportunity that could impact a company's financial performance.

Impact Materiality: This "inside-out" view looks at how a company’s activities affect the environment, society, and stakeholders.

Double materiality is firmly placed at the heart of the evolving landscape of sustainability regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the Task Force on Climate-related Financial Disclosures (TCFD).

Whilst the TCFD made recommendations towards disclosing with double materiality in mind, the CSRD explicitly embeds it, and requires that companies provide detailed disclosures that include climate risks, resource use, biodiversity impact, and human rights considerations.

Unlike traditional financial materiality, where companies report only on risks that affect their bottom line, double materiality requires them to consider their broader societal and environmental impacts.

Why is Double Materiality Important?

Regulatory Compliance: Many jurisdictions, particularly in Europe, are mandating double materiality across sustainability disclosures. In practice, businesses must begin disclosing, reporting, and now with the CSDDD, showing that they are taking concrete action on improving their sustainability credentials.

Investor and Stakeholder Expectations: Both investors and customers increasingly demand transparency on ESG risks and corporate impacts.

Long-term Risk Management: Companies that ignore their impact on the environment and society could face future financial, reputational, and operational risks.

Double Materiality in the Here and Now: The 2025 California Wildfires

One recent and visceral example of double materiality’s importance is the California wildfires, most notably those in Palisades and Eaton. The fires burned around 40,000 acres and caused $250-$275 billion worth of damages (Forbes). Such environmental disasters can cause staggering economic and social costs, even in one of the wealthiest communities on the planet.

As the climate continues to warm there will be heightened risk of more frequent and more intense fires. Not only do companies and investors face financially material outcomes through property losses, supply chain disruptions, and insurance risks, but they also contribute to creating the conditions for those disruptions through carbon emissions, land mismanagement, and unsustainable development. Double materiality is about understanding the reciprocal nature of business activities and making certain that these impacts are accounted for and mitigated.

Financial Materiality: How Wildfires Impact Businesses

The increasing frequency and intensity of wildfires pose direct financial risks to companies. Some key areas of financial materiality include:

Physical Risks: Damage to infrastructure, supply chain disruptions, and increased insurance costs.

Regulatory Risks: Stricter emissions laws, liability for contributing to climate change, and legal consequences.

Market Risks: Shifting consumer preferences toward more sustainable brands and potential devaluation of properties in high-risk areas.

As an example: One of California’s largest utility companies PG&E incurred over $5 billion in settlements and filed for bankruptcy after being found liable for a series of wildfires between 2015 and 2018. Following one fire incident in the Napa Valley in 2017, PG&E’s share price declined by an eyewatering 91% (TNFD 2024).

Impact Materiality: How Businesses Impact Wildfire Risks

While companies are affected by wildfires, their operations can also increase the risk these disasters. Some key areas of impact materiality include:

Carbon Emissions: Companies in high-emission industries contribute to climate change, increasing wildfire risks through warming temperatures.

Land Use and Resource Management: Deforestation, poor land management, and urban expansion can worsen susceptibility to wildfires.

Supply Chain Practices: Sourcing from areas prone to wildfires without considering mitigation strategies can lead to long-term environmental and social harm.

For instance, sectors such as agriculture, real estate, and energy have a material impact on wildfire risk through deforestation, water usage, and infrastructure development. These stories demonstrate not only how climate risks can materially affect a company’s financial stability, but also how deeply intertwined economic activity is to the natural world.

The Future of Double Materiality

As regulatory bodies tighten reporting requirements and climate risks become more present, double materiality will play an increasing role in corporate strategy. Companies that integrate both financial and impact materiality into their decision-making can expect to:

Improve resilience against climate-related risks.

Strengthen investor confidence and consumer trust.

Align with global sustainability goals and regulations.

More than a compliance requirement, double materiality is a framework for responsible business practices in a world where financial success and environmental sustainability are deeply interconnected. The example of the 2025 California wildfires serves as a stark and timely reminder of why businesses must consider both how they are impacted by climate risks, as well as how they contribute to them. Utilising a double materiality approach allows companies to become stewards of the natural world and protect their own bottom line in a changing environment.

As companies prepare for a future shaped by ESG regulations and climate challenges, embracing double materiality will be essential for long-term resilience and value creation.