Top Tips for Due Diligence Teams When Creating DDQs - Part 1

Aurelien Poulet explains why due diligence teams should take care when designing DDQs. Designing DDQs with the responding managers in mind will help...

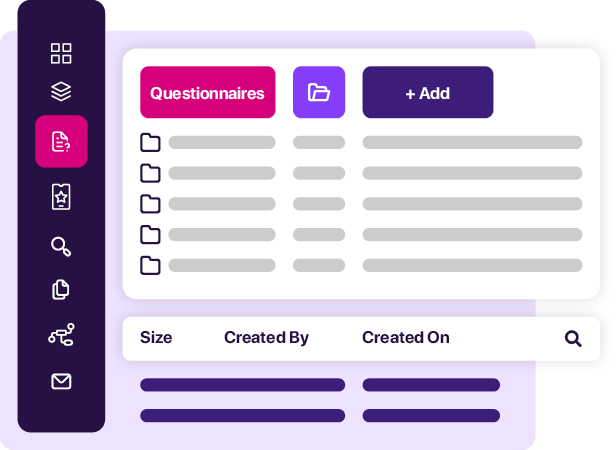

Equip your operational due diligence team with award-winning advanced automation and collaboration tools

AI powered for speed and efficiency, this platform helps you make short work of due diligence, pre or post investment.

With a lot of data coming into the ODD team in different formats and from different sources, it can be hard to keep track.

Without flagging and alerts, data collection may be incomplete or formatted incorrectly. Important disclosures could be missed.

The DDQ process can be lengthy and complex, multiplied as the number of managers increases.

Manual data collection processes may not be as accurate as required.

With manual processes, it can be difficult to maintain a clear audit trail that may be needed in the event of a review or investigation.

Over time, ODD processes become heavily dependent on specific individuals in the ODD team, which poses a risk of key person dependency.

As allocator portfolios become more complex, it becomes harder to initially review and continually monitor managers at an ever increasing pace.

Regular ODD exercises can be repetitive and tedious, with ODD teams scouring and comparing documents for changes.

People are an organization’s biggest asset, but also, its greatest risk. Automation removes or significantly reduces the human element from data collection and classification tasks and reduces the risk posed by human error.

Allocators and fund managers are both working towards a similar goal; to achieve a frictionless exchange of critical data that will allow the relationship to prosper. By digitizing the process and providing user friendly platforms that make it easy to request and provide data, allocators will foster greater collaboration with the fund manager ecosystem.

ODD teams report improvements of around 5x in productivity levels following the move to a digitized ODD process. An entire quarter’s worth of work can be reduced to 3 weeks. The efficiencies gained by requesting, gathering, flagging and analysing data automatically and at scale, allow ODD teams to focus on other more meaningful tasks.

Go from reactive to proactive by quickly digitizing best practice templates as soon they are released. When both qualitative and quantitative information is turned into digital data, analytics can be used to find patterns and create benchmarks.

Aurelien Poulet explains why due diligence teams should take care when designing DDQs. Designing DDQs with the responding managers in mind will help...

Discover the essential steps of due diligence in investment decision-making and how technology can streamline the process for investors and asset...

Due diligence is evolving rapidly with driving factors like the emergence of AI tools, increased qualitative ESG reporting, and mandatory...

Step by step guide to transforming your manual ODD process

Ten steps to creating DDQs your managers will find easier to answer